Let CPA Launch Handle Your Books So You Can Focus On Growing Your Business

Join Our Hundreds of Bookkeeping Clients In Focusing On Growth Not Spending Time Keeping Their Books Clean

Less Time Spent Doing Your Bookkeeping. More Time Spent Building Your Business!

Peace of Mind

With CPA Launch you will never stay up at night worrying about your books being completed or being accurate.

Take Back Your Time

Outsourcing your bookkeeping with CPA Launch allows you to have more time to focus on growing your business.

Avoid CRA Penalties

Our bookkeeping experts ensure your books are kept to every CRA requirement so you never have to pay penalties.

What's Included With Your Bookkeeping Services

Tired of spending so much money but not understanding where it is going? Our services are the key solution!

Payroll

Employees paid on time

Tax & other deductions correctly calculated

Accurate pay stubs and T4s

Guaranteed CRA compliance

Tax Filing Ready Books

Monthly bookkeeping entries

Prepared financials for T2 filings

CPA certified accuracy

Guaranteed CRA compliance

AP & AR Management

Ensure all invoices are paid on time

Pay suppliers before the due date

Ensure AP are fuelling business growth

Guaranteed CRA compliance

Our Complete Business Accounting Suite

Need ongoing and actionable financial insights? Explore our other business accounting services!

Fractional CFO

CPA prepared budgeting

Ongoing financial insights and reporting

Track your financial KPI's

Have an on-call CPA for your business

Tax Preparation

Ensure you pay the CRA as little as possible

T2 preparation and filing with the CRA

CPA prepared and certified filing

Tax planning for your business

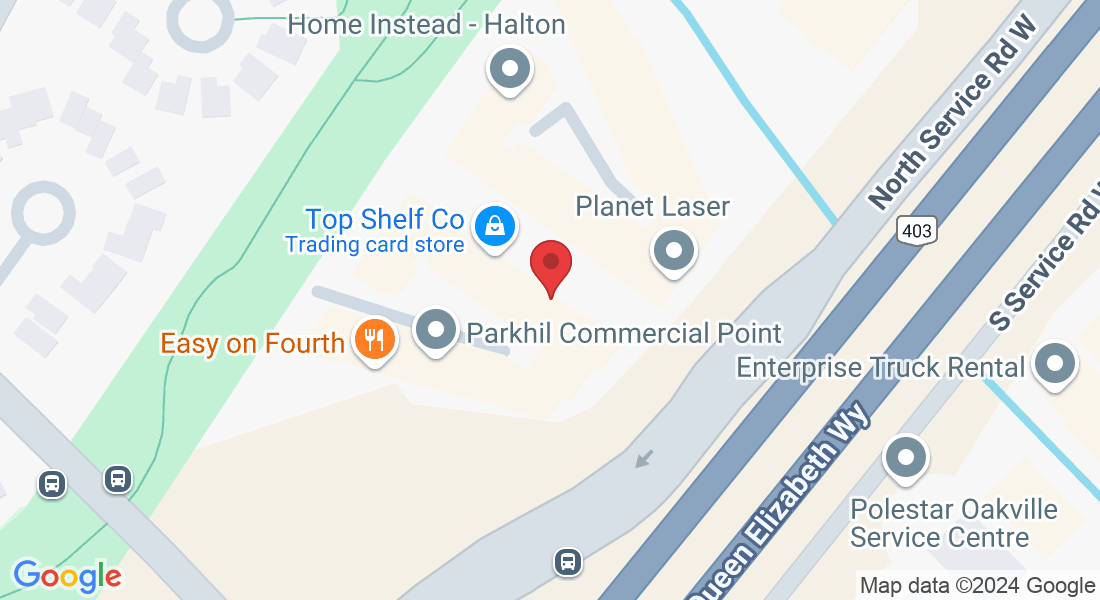

Welcome To CPA Launch

Hamilton's Bookkeeping Experts

Being a business owner is too hard to also be a full time bookkeeper! At CPA Launch we take care of our clients' books so they can focus on making more money in their business.

Our bookkeeping systems ensure that when it comes time to file taxes at year-end, our clients are confident that all their books and accounts are accurate, offering a stress-free tax season.

Jack Ogus

Managing Partner at CPA Launch

Ready To Get Your Bookkeeping In Order?

What Our Clients Say

You ARen't the first to ask these

Frequently Asked Questions

Why Should I Outsource My Bookkeeping

Peace of Mind

To give you peace of mind, a good bookkeeping service will help you focus on your business while they focus on the numbers.

Scalability

Hiring an outsourced bookkeeping service with controller oversight and a full-service offering enables the service to scale to needs without hiring or training additional staff.

Training

Most business owners are not in the position to be able to train or manage bookkeeping staff–primarily because their bookkeeper likely knows more about it than they do. However, the benefits of having a bookkeeper with up-to-date comprehensive knowledge of tax rules or reporting methods make a big difference in the quality of bookkeeping.

Maximize Resources

When business owners try to save money by doing their own bookkeeping or delegating it to another key employee, they spend valuable time and energy that could be better used growing the business. When they outsource their bookkeeping services, they free themselves up to spend their time doing what they do best.

What Types of Businesses Need Bookkeeping Services?

All businesses benefit from bookkeeping, including small businesses, freelancers, startups, and corporations. It ensures you stay on top of financial obligations and make data-driven decisions.

Can You Help with GST/HST Filing and Compliance?

Absolutely! We ensure your GST/HST filings are accurate and submitted on time, helping you avoid penalties and stay CRA-compliant.

Can You Clean Up Old or Messy Books?

Yes, we specialize in organizing and reconciling historical records to ensure your books are clean, accurate, and ready for future growth.

Does You Offer Virtual or Online Bookkeeping Services?

Absolutely! We offer secure, cloud-based bookkeeping solutions that allow you to access your financial data anytime, anywhere.

What Is The Difference Between Bookkeeping & Accounting

Bookkeeping records daily financial transactions, while accounting focuses on analyzing and interpreting that data for tax filing, reporting, and strategic planning.

How Can a Bookkeeper Help my Business?

A bookkeeper ensures your financial records are accurate and up to date, helping with cash flow management, tax preparation, payroll, invoicing, and compliance with CRA regulations.

Get Started With CPA Launch Today!

Who Needs Our Bookkeeping Services

Small businesses (including sole proprietors)

Corporations

Franchises

Startups

All businesses

Other Accounting Services

Fractional CFO

Get a year-round financial and accounting advisor.

Corporate Tax

We handle all your corporate tax needs.